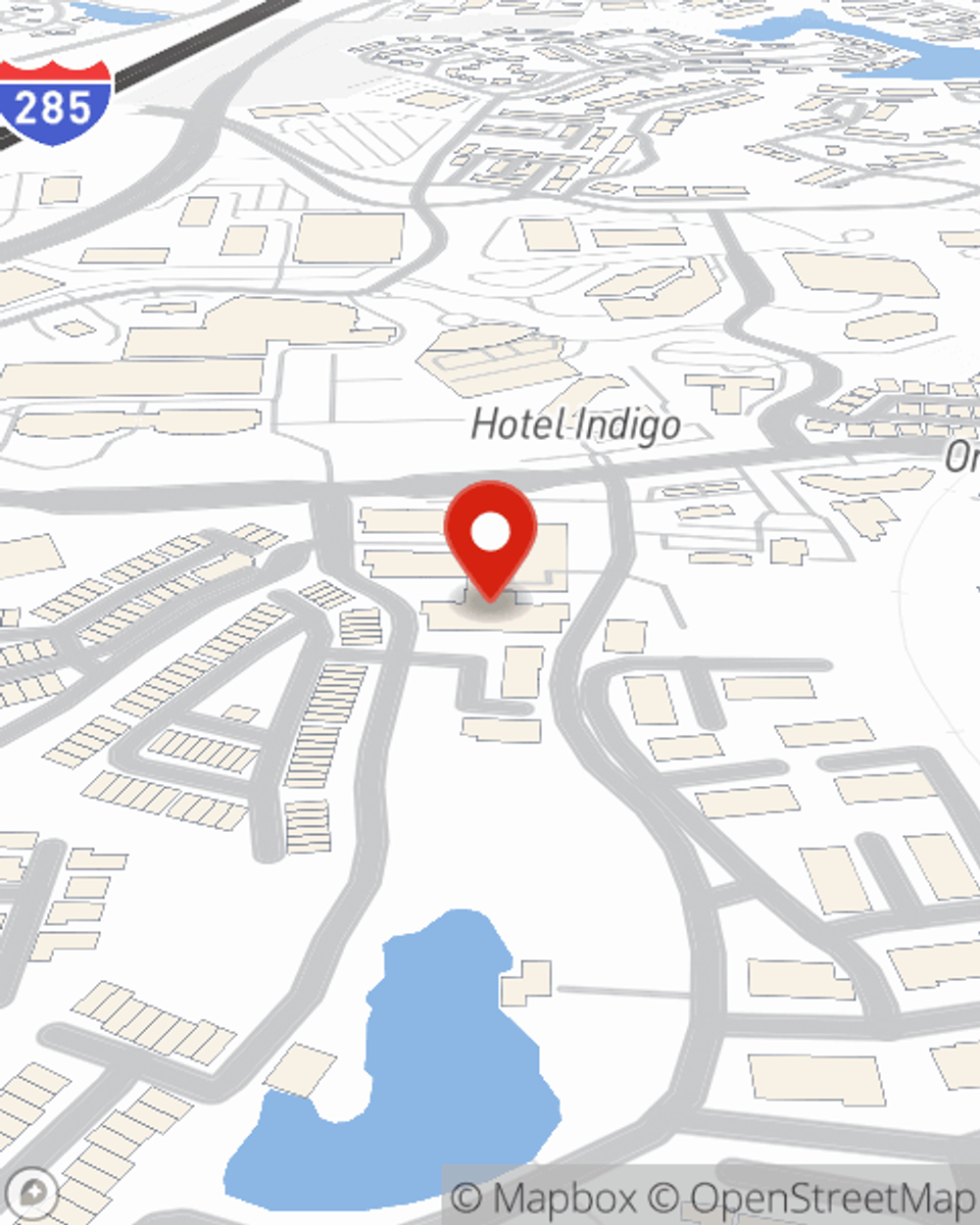

Life Insurance in and around Atlanta

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

It may make you weary to think about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can demonstrate love to your loved ones.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

Having the right life insurance coverage can help loss be a bit less debilitating for your loved ones and give time to recover. It can also help meet important needs like childcare costs, car payments and your funeral costs.

When you and your family are insured by State Farm, you might rest assured that even if life doesn't go right, your loved ones may be covered. Call or go online today and discover how State Farm agent Tyler Hood can help you protect your future.

Have More Questions About Life Insurance?

Call Tyler at (770) 955-1485 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.